top of page

Blogs

Search

MCA Companies Compliance Facilitation Scheme, 2026 (CCFS-2026): 90% Additional Fee Waiver

MCA Companies Compliance Facilitation Scheme, 2026 (CCFS-2026): 90% Additional Fee Waiver

Asif Hussain

3 days ago5 min read

Sale of Flat to NRI Buyer in India vs. NRI Seller Selling Flat to Indian Resident

The real estate transaction rules vary depending on whether a property is being sold to an NRI buyer in India or when an NRI sells property in India to a resident Indian. Both situations involve compliance under the Income Tax Act and the Foreign Exchange

CA Umang Jain

Sep 3, 20252 min read

ITR for People Receiving Foreign Income and Assets: Focus on Conversion & Reporting

Indian residents receiving salary, stock benefits, dividends, or capital gains from foreign entities must report such income and assets in their Income Tax Return (ITR). Key obligations include precise currency conversion using SBI TTBR, accurate disclosure in relevant ITR schedules, and adherence to international information-exchange standards for tax transparenc

CA Umang Jain

Sep 2, 20253 min read

Dual Residency & Taxation in India: A Complete Guide for NRIs, Expats & Returning Indians ITR filings

Confused about being taxed in two countries? Discover how residency rules, DTAA relief, and smart planning can save you from double taxation and unnecessary stress.

CA Umang Jain

Aug 22, 20253 min read

What are the documents required for TAN Registration

Applying for a TAN (Tax Deduction and Collection Account Number) is a crucial step for any individual or entity that is responsible for deducting or collecting tax at source in India. Issued by the Income Tax Department, TAN is mandatory for filing TDS/TCS returns and ensures that tax deductions are properly tracked and credited.

Shubhom Ghosh (CA Finalist)

May 28, 20252 min read

Documents Required for MSME Registration in India & Its Benefits

MSME registration in India offers various benefits like easier loan approvals and tax exemptions

CA Umang Jain

May 19, 20252 min read

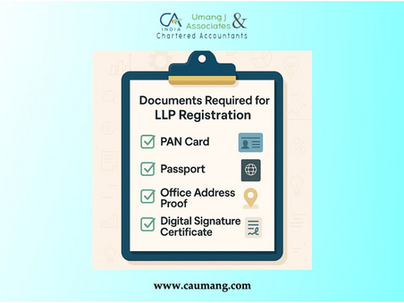

Documents Required for Registration of an LLP in India

Thinking of starting your own LLP? Discover the essential documents you need for LLP Registration with ease and confidence! Essential...

CA Hemant Bardia

May 8, 20252 min read

Tax Alert: Wristwatches, Yachts, and More Now Under TCS Net

Luxury now comes with a tax tag! From yachts to wristwatches, the CBDT casts a wider net under TCS rules—find out what’s new in your...

Asif Hussain

Apr 23, 20252 min read

Two types of Sub-Contracting under Construction Business and its GST implications.

Construction projects involve multiple companies collaborating to complete a contract. Typically, one company oversees the project and...

Asif Hussain

Mar 29, 20253 min read

Rule 86B – Mandatory 1% cash payment on output GST

Rule 86B, since its introduction, has faced strong criticism for restricting the use of input tax credit (ITC) from the electronic credit...

Asif Hussain

Mar 29, 20253 min read

Dematerialisation of Shares: A Mandatory Shift for Private Companies

The Ministry of Corporate Affairs (MCA) has introduced a significant regulatory change in corporate governance through the Companies 2nd Ame

CA Umang Jain

Mar 29, 20253 min read

Compliance Calendar for FY25-26

Compliance is not expensive, rather compliance planning is one that lets you save huge amount of avoidable burden of Interest, Penalty...

Asif Hussain

Mar 22, 20257 min read

bottom of page